23+ j1 visa tax calculator

Your household income location filing status and number of. 20 to file it.

Income Tax Accounting Bolla

If money has been earned then also file either the 1040NR or 1040NR-EZ.

. Web J-1 visa holders are entitled to claim tax refunds on both federal and state taxes. Web Our income tax calculator calculates your federal state and local taxes. Ad Dont Leave Money On The Table with HR Block.

Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. Web Even if you still are on a J-1 visa but have been in the United States in 2017 and 2018 you can count the days in 2019. Then just mail it in.

For foreign seasonal workers these three figures are zeroes. Web Web The answer is yes J-1 visa holders can receive tax refunds just like their US. 2022-2023 Refund and Tax Estimator Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a.

All non-residents must pay 10 on any income tax up to 11000. Web All J visa holders must file a return. If the J-2 has not earned money in the United States file Form 8843.

Web OPT as well as individual students are taxed on their wages at graduated rates from 10 to 396 it depends on your income level. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Web There are different J-1 visa tax rates depending on factors such as your income.

Web Just grab a calculator and knock it out in a few hours or less. The tax percentage withheld. Get Upfront Transparent Pricing with HR Block.

All you need is your W2 and whatever other documents apply to you. You are considered a resident alien for tax. Whether you will receive a USA J-1 tax refund depends on the status.

Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like. To do that file your tax return. Life Has Enough Surprises.

Web These are usually 62 for Social Security up to 62 for Federal Unemployment and 145 for Medicare. Web The answer is yes J-1 visa holders can receive tax refunds just like their US. Its hard to say how long itll take for you to get your.

Get Your Max Refund Guaranteed. Web Get Your Tax Record Apply for an Employer ID Number EIN Check Your Amended Return Status Get an Identity Protection PIN IP PIN File Your Taxes for Free.

The Complete J1 Student Guide To Tax In The Us

J 1 Visa Tax Exemptions And Tax Treaties Global Internships

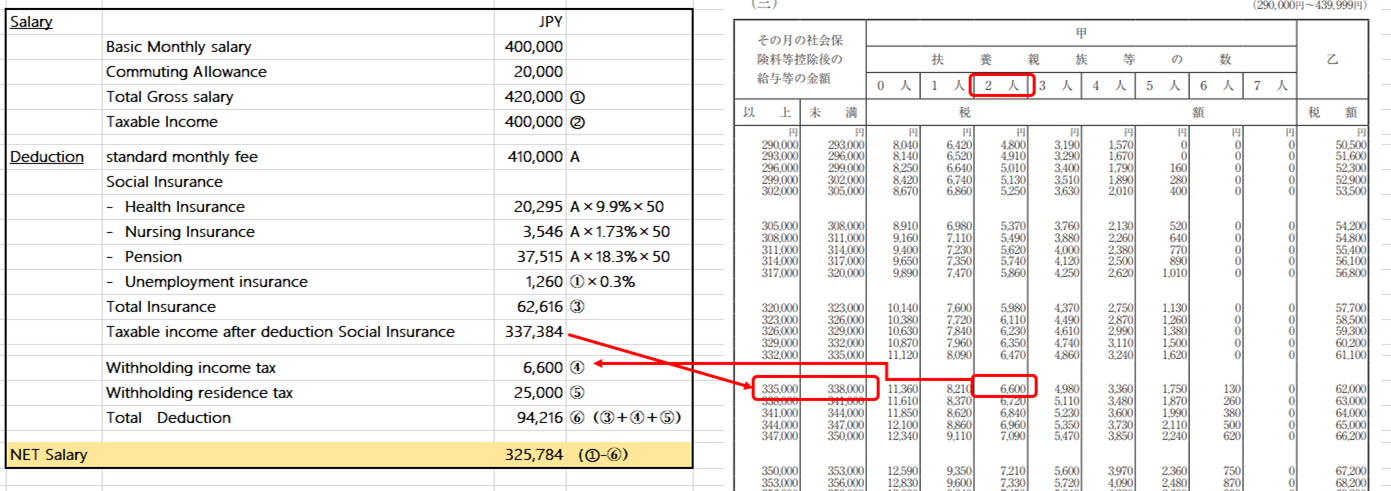

Payroll Services In Japan How To Calculate Monthly Payroll Withholding Income Tax Social Insurance Shimada Associates

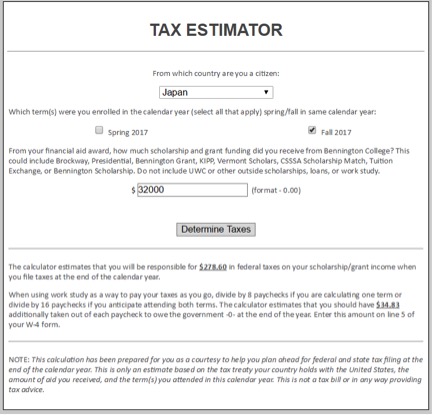

Tax Estimator For International Students Bennington College

J 1 Visa Tax Exemptions And Tax Treaties Global Internships

مؤسسة بنيان التنموية موقع ووردبريس عربي آخر

The Complete J1 Student Guide To Tax In The Us

Austria Taxing Wages 2020 Oecd Ilibrary

How To File J 1 Visa Tax Return 101 Tfx

J 1 Visa Tax Exemptions And Tax Treaties Global Internships

The Complete J1 Student Guide To Tax In The Us

Setting Up Tax Information

J 1 Visa Tax Return Information Documents And Application

Us J1 Tax Refund Calculator Taxback Com Youtube

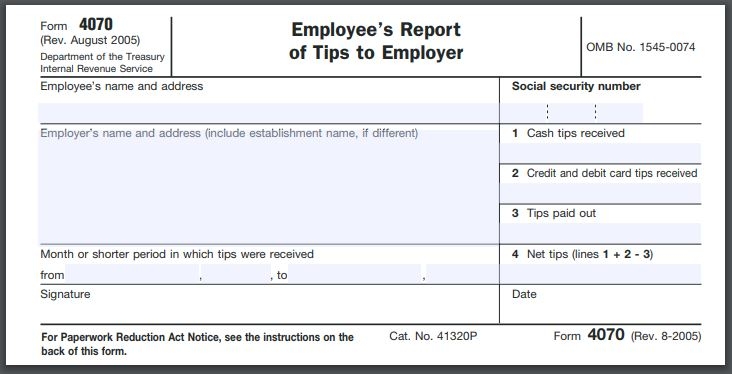

Tax Calculator Employer Tax Benefits J1 Visa Students Exempt From Fica And Futa Taxes

The Complete J1 Student Guide To Tax In The Us

Disabling Salary Proration In Tax Calculation Mid Month Hiring And Termination Sap Blogs